Cars are going electric but the rising piles of their used batteries will become a very big problem three to four years down the road. But the world can’t wait three to four years for a solution. “We need one now,” says Bryan Oh, chief executive of NEU Battery Materials, a Singapore-based startup that takes a unique approach to battery recycling.

Electric vehicles (EVs) put on the road in 2019 alone will eventually produce 500,000 tonnes of battery waste. By 2040, two-thirds of all car sales are expected to be electric generating 1,300 gigawatt-hours of waste batteries, according to the International Energy Agency. Currently, only about 5 per cent of Lithium-ion batteries, the rechargeable batteries most commonly found in EVs, are recycled globally.

Disposing of lithium, which is prized for its conductive properties, is particularly problematic. Typically, lithium isn’t recovered from the battery recycling process, because recycling it is complicated and involves multiple stages to purify it. A lack of a viable alternative means that it is currently cheaper to mine more lithium than recycle it. But this could change as global lithium supply comes under pressure.

To continue reading, just sign up – it’s free!

- Get the latest news, jobs, events and more with our Weekly Newsletter delivered to you free.

- Access the largest repository of news and views on sustainability topics.

- You can publish your jobs, events, press releases and research reports here too!

Newsletter subscribers do not necessarily have a website account. Please sign up for free to continue reading!

Demand for lithium has quadrupled in the past 10 years. As a result, lithium prices have soared, quadrupling in a year. Elon Musk, the chief executive of electric automaker Tesla, said earlier this year that he would consider mining the element himself, to bring prices under control. Mining expert Joe Lowry said last week that lithium supply is falling worryingly short of demand, which is projected to be 14 times greater by 2030.

“

People drive a Tesla because they want to be green. But they don’t realise how much pollution is created from mining materials and manufacturing EVs.

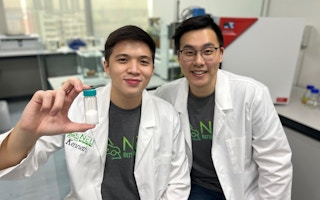

Bryan Oh, founder and chief executive, NEU Battery Materials

How does NEU’s battery recycling technology work?

NEU’s technology focuses on lithium iron phosphate (LFP) batteries. This is a type of lithium-ion battery increasingly used by Tesla and other major EV makers.

LFP batteries do not contain nickel or cobalt, so are usually considered of lower recycling value than other types of lithium-ion batteries. NEU’s technology can extract the lithium at lower cost.

An electrochemical process separates the batteries into iron phosphate and lithium hydroxide, at a recovery rate of more than 95 per cent and purity levels of about 99 per cent for both materials.

This process for producing battery grade lithium is up to 100 times less polluting and up to 10 times more profitable compared to existing recycling technologies, according to NEU.

Oh, who was among the winners of sustainability solutions contest The Liveability Challenge in 2021, believes his firm’s technology is a gamechanger in keeping lithium supply in circulation, using a method that has a low environmental impact.

Typically, recovering metals from batteries involves burning or using acid — both polluting processes. Oh’s method, which was developed by the National University of Singapore (NUS), uses electricity to extract the lithium from used batteries. This reduces the amount of chemicals and water needed in the process.

The technology is still in its pilot phase but Oh has ambitious plans to expand overseas and set up up in major EV markets, like China and Europe. He is about to close another round of seed funding as he eyes scale.

In this interview with Eco-Business, Oh talks about the impact of Covid and soaring lithium prices on his venture, the challenges of finding talent in an emerging industry, and what he wants to say to Elon Musk.

What impact has the high price of lithium had on your venture?

By next year, some reports predict that there will not be enough lithium to support EV growth. The price increase is a clear sign that there is not enough supply. The price will continue to go up, and that could hurt EV adoption. Consumers are not going to pay double the price for an EV car. It’s urgent that we find alternative sources of raw materials to sustain industry growth.

What impact did Covid have on your venture?

We were born out of Covid. Before Covid I was working on a startup called PortaLockers, a portable storage system. Covid killed my startup, but it did give me the opportunity to work with the NUS Graduate Research Innovation Programme (NUS GRIP), out of which NEU Battery Materials was born.

There have been many downsides to Covid — I got the sense that businesses were less open to innovation, it was difficult in the beginning. But Covid did drive a change in the market perception of EVs. In 2019, nobody was really talking about electrification. But in 2020, we started to see regulations pushing for EVs as pressure grew on governments to fight climate change.

How far are you from being a fully functioning, commercially viable lithium recycler?

Our first milestone is to build the pilot site in Singapore, which should be up and running by the third quarter of this year. It may not be fully automated, but we will be able to collect all the data we need to scale the operation. We can achieve scale easier than other recyclers, because we use a cell stacks system that works like Lego. It allows us to adapt to changing market demand very quickly.

The EV market in Singapore is still young. Will you have enough used battery feedstock to sustain the business?

There isn’t the same level of feedstock in Singapore as there is in other markets, like China, Europe and the United States. So we will be looking to expand overseas over the next few of years. There is already a decent supply of lithium iron phosphate (LFP) batteries in Singapore from older EVs, hybrid vehicles, energy storage units, power tools and forklifts. We’re working with a battery crushing company in Singapore, Secure Waste Management, that provides us with feedstock.

Where will you look to expand?

Where the big global EV markets are. Lithium is a key commodity for EVs. All of the world’s big EV markets are setting up their own domestic supply chains for EVs. Shipping batteries is more dangerous than transporting your average household products, so there’s a need for local recycling infrastructure to keep EVs materials in circulation locally. It also reduces logistical costs and the carbon footprint of production. This is why Tesla is setting up a new giga factory [which makes lithium-ion batteries and electric vehicle components] in the US, in addition to its factories in Europe and China. In China, more than 60 per cent of batteries are LFP now — and nobody’s recycling it. It’s an untapped market.

Clearly there’s a huge market opportunity for your technology, and the timing seems to be right. But what are the key challenges you’re facing?

One is regulatory support. This is still a new industry, and some regulations still need to be worked out along the way. But I feel the Singapore government is supportive of EVs [the government recently set a new target to reduce the city-state’s land transport emissions by 80 per cent from its 2016 peak “by or around mid-century”, and plans for every public housing area to be EV-ready by 2025].

Another is finding the right talent and skillset in a new field in a country with a young EV market [Oh is currently looking to hire an electrochemical engineer], particularly as we look to scale. Our company is built on technology. As long as we can demonstrate the technology with a successful pilot, the business and the partners will come, because we offer a recycling solution that nobody else has. People form the core of our technical knowledge, and we’re always looking for more.

Also, getting noticed by car manufacturers is not easy, as we are still small. I know that Tesla will be interested in us, as they will need to find a recycling solution in Singapore. If I could have five minutes with Elon Musk, I just need to tell him that we are recycling LFP batteries. I’m hoping that with the pilot site, we’ll be able to attract these guys to come down to look at what we’re trying to do.

Pressure on supply of the materials needed to make electric cars has provided impetus to supporters of deep-sea mining. What are your thoughts on deep-sea mining?

Deep-sea mining could ruin ocean ecosystems so that we can electrify the transport industry. It is ironic that we would be destroying the environment to protect the environment. But I do understand the reasons for deep-sea mining. Governments are in a race to electrify transport. If they don’t electrify as fast as other countries, they lose competitive advantage.

Where do you see yourself in five years’ time?

I hope that we will have a global presence, with Singapore as the hub for innovation, with around 100 people. We’ll be recycling all LFP batteries and reducing a proportion of the waste from the EV industry. I want to create an industry that is clean and sustainable. People drive a Tesla because they want to be green. But a lot of people don’t realise how much pollution is created from mining materials and manufacturing EVs. We want to be able to offset some of this pollution.

This interview has been edited for brevity and clarity.

This story is part of a series on the finalists of The Liveability Challenge, an annual search for solutions to make Southeast Asia’s cities cleaner, greener places to live and work, backed by Temasek Foundation.