The Asian Development Bank (ADB) is encouraging developing nations in Southeast Asia to tap sustainable development goals (SDG) bonds, to aid the recovery of ailing economies still reeling from the impacts of the Covid-19 pandemic and to help them meet the United Nation’s Sustainable Development Goals (SDGs).

The Sustainable Development Goals Accelerator Bond (SAB), offers investors a structured payment guarantee mechanism and cheaper funds for projects to help meet climate and SDG targets. The SDGs are a series of ambitious targets to tackle global issues such as poverty, hunger, climate change, and gender equality by 2030.

The new bond should help countries reduce the perceived investment risks posed by an issuing entity, sector, or project with no track record on bond issuance, providing coupon rates and exit guarantees as incentives for investors, the bank said in a report released on Friday titled Accelerating Sustainable Development after Covid-19: The Role of SDG Bonds.

The framework will allow variations in fund structure among countries and issuers of the accelerator bond or other SDG bonds, the ADB said.

“The Covid-19 pandemic has slowed down the momentum for sustainable and equitable growth in most of developing Asia and many countries are at risk of not meeting their SDG targets in climate resilience, gender equality, and human development,” said ADB vice-president Ahmed M. Saeed.

“For countries looking to fund sustainable projects and programmes on a large scale, capital markets represent an underused but viable mechanism to bring in SDG investments.”

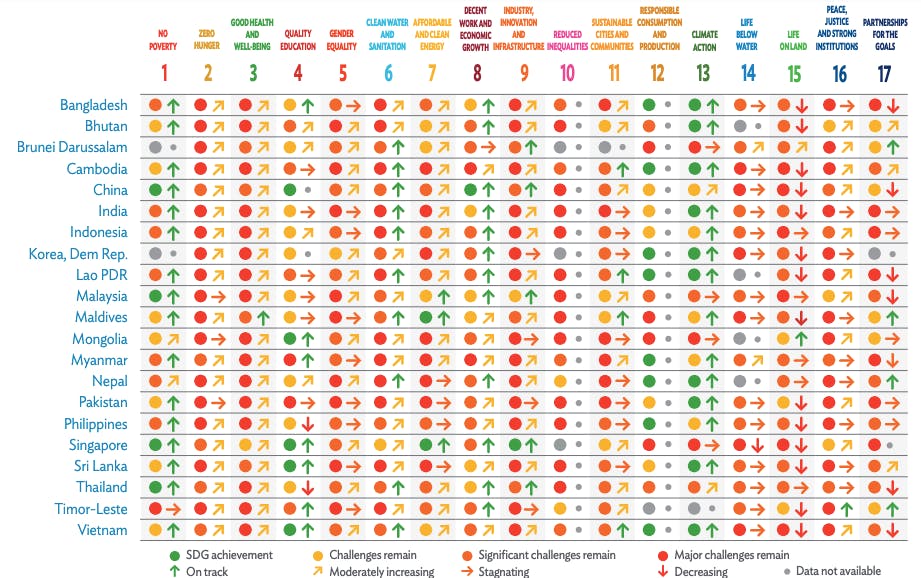

SDG Levels and trends for East, South, and Southeast Asia, 2020, Image: ADB

Plugging the finance gap

Although Southeast Asian countries issued a record US$12 billion in green, social and sustainability bonds in 2020, their financing needs have only grown amid the biggest public-health crisis in a century, noted the ADB study.

Developing countries in Southeast Asia were already struggling to fund initiatives to achieve the SDGs before Covid hit. The UN estimates that the region will require US$210 billion per year from 2016 to 2030 to support investment in climate-compatible infrastructure, renewable energy, energy efficiency, food security, agriculture, and land use.

Achieving the SDGs will be all the more challenging with the onset of a Covid-induced economic downturn in the region for the first time in six decades with US$163 billion to US$253 billion in projected losses in gross domestic product, the study said.

The financing mechanism should help supplement the public purse and support projects that contribute to the SDGs but are not commercially bankable. The SAB bond could also help cash-strapped state-owned entities, and city-level projects that support one or more of the SDGs, access funds.

Financing a green recovery

The SAB may be used for green recovery strategies in Southeast Asia to help tackle climate change and support projects that will address climate change mitigation and adaption.

“SAB is certainly useful in supporting projects that address the challenges emerging from the current pandemic. ADB is suggesting “green” recovery strategies be adopted by the countries for mitigating the impacts by Covid,” the bank said.

Thailand, for example, issued its first sustainability bond issued in August last year. Thailand’s sustainability bond offers two tranches of fixed rate government bonds for a total amount of about US$964 million. The proceeds will be used to finance green infrastructure in Bangkok’s Mass Rapid Transit Orange Line (East) Project which was certified against Climate Bonds Standards under its low carbon transport sector criteria, as well as other social projects supporting the country’s Covid-19 recovery like SDGs 3 (public healthcare) and 8 (employment generation).

Other green recovery projects that the SAB could potentially support include the Epifanio de los Santos Avenue (EDSA) Greenways Project in Manila, Philippines.

The bank approved a US$123 million loan to construct five kilometres of covered walkways linked to mass transit stations along the country’s main thoroughfare, as part of the city’s recovery from the pandemic. It is expected to create much-needed jobs during the construction period, with US$61 million to be spent on local raw materials.