Two wars raging and geopolitical tensions escalating globally did not stop businesses from adopting innovations and making improvements to strengthen their supply chains this year.

Generative artificial intelligence (AI) burst onto the scene as ChatGPT became the world’s most popular AI platform, attracting 100 million users just two months after its launch. But as businesses embrace the technology to increase productivity and cut costs, there are now widespread calls to protect and support workers, to make sure that automation improves the workplace and does not end up threatening jobs. These efforts are likely to continue.

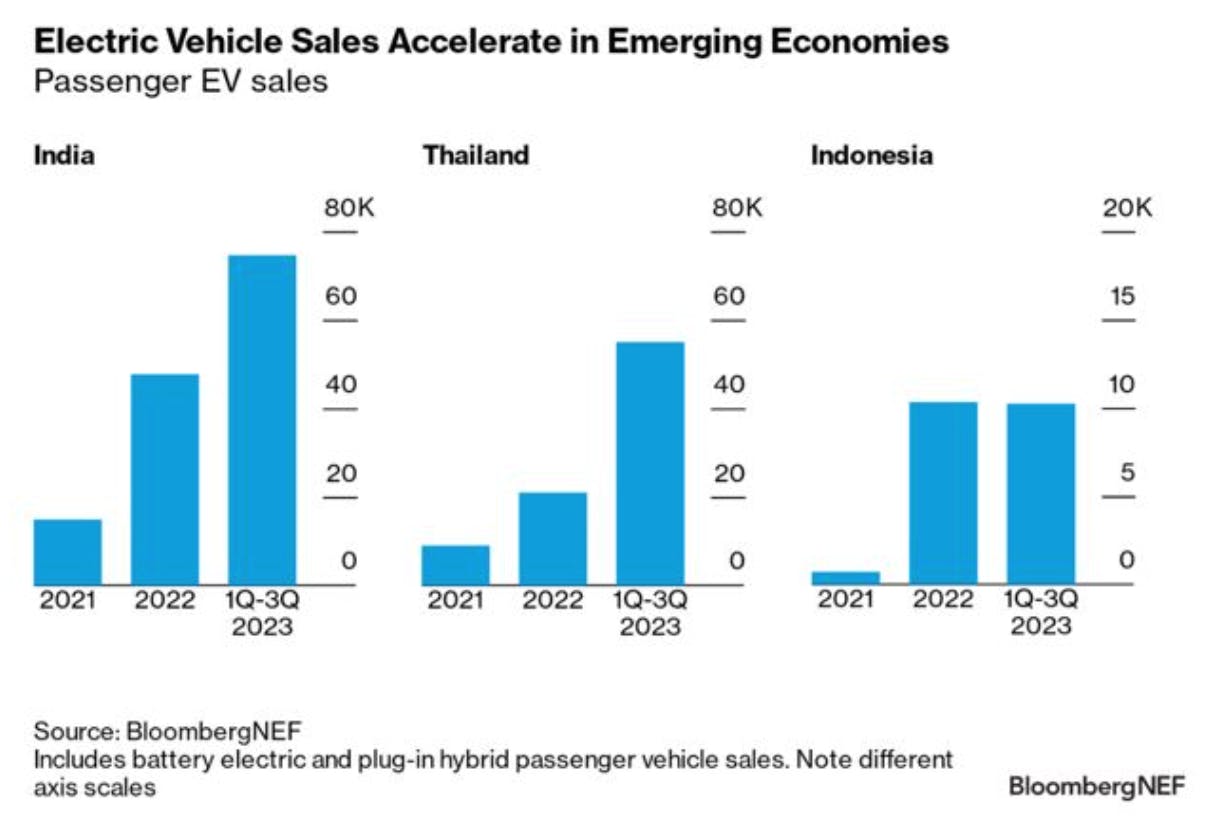

Electric vehicle (EV) adoption is rising quickly in emerging economies like India, Thailand and Indonesia, where low-cost models are driving demand.

To continue reading, just sign up – it’s free!

- Get the latest news, jobs, events and more with our Weekly Newsletter delivered to you free.

- Access the largest repository of news and views on sustainability topics.

- You can publish your jobs, events, press releases and research reports here too!

Newsletter subscribers do not necessarily have a website account. Please sign up for free to continue reading!

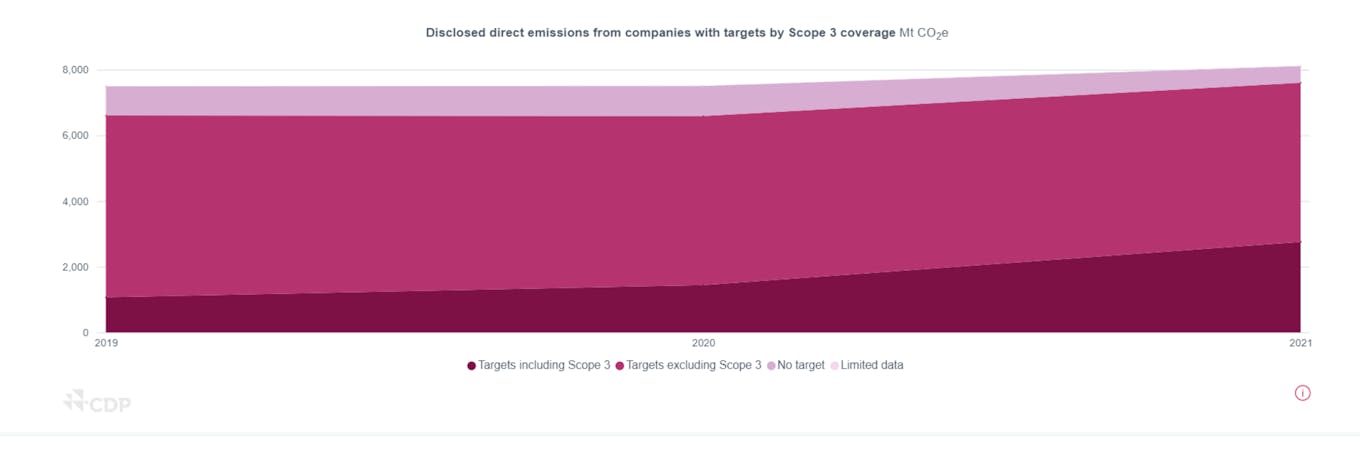

Stricter regulations have prompted corporates to keep track not just of their direct emissions, but also those from their suppliers and end-users.

Eco-Business identifies five major trends that will shape business and society in 2024.

1. Heightened call to protect workers amid latest wave of AI innovations

Rapidly advancing technology has not driven conversations as significantly as generative AI has in the past year.

By showing how it can write a science fiction novel in a few hours to being able to interact with clients in various languages, ChatGPT has stirred controversy as it threatens to displace as many as 300 million jobs via automating them.

Artists and illustrators in the US are using the hashtag #artbyhumans as a form of silent protest against the surge of AI-generated images. Image: No to AI Generated Images

A survey in September by London-based market research firm Mintel Trends studied global consumer behaviour and found that half of the respondents in Asia Pacific worry that AI will make their jobs obsolete, despite 57 per cent saying they know little about AI.

In the same analysis, 69 per cent of respondents said they were opposed to buying from companies who behave unethically by misleading consumers and mistreating employees, while 73 per cent said companies should do more to address inequality like fair pay and support for vulnerable populations.

These findings signal a “strong moral thread” across the region that indicates that protecting the rights of workers against inequality and mistreatment will increasing become the norm, said Matthew Crabbe, Asia Pacific director of Mintel. This includes looking into how jobs could potentially be threatened by modern technology,

“A new ‘human-as-premium’ label will emerge, giving greater influence to artisans who can take on the creative spirit that exists outside of an algorithm,” said Crabbe.

“As more businesses embrace AI to increase productivity and cut costs, there will be widespread calls to protect and support workers, rather than make them redundant.”

Consumers will need time to adjust and learn how to make technology more applicable at the individual level, sparking new discussions and innovations around how to be intentional about blending the digital and the physical, Crabbe added.

2. EV fast tracking in developing Asia

Sales of EVs in China have soared in recent years, representing around a quarter of the world’s market. In the homefront, China’s Hainan province has set Asia’s most ambitious target to phase out sales of traditional vehicles by 2030.

However, unlike solar technology, which with its cheap price makes it an attractive investment, EVs have not made as much impact to the rest of the developing world due to comparatively high purchase prices and a lack of available charging infrastructure.

At COP28, 56 wealthy governments, including the United Kingdom, Sweden and Germany pledged international assistance spanning finance, supply chain development and technical expertise for emerging markets with the ambition of making EVs the “most affordable, accessible, and attractive option in all regions by 2030”.

But even without this foreign assistance, countries in developing Asia like Thailand, Indonesia and India are determined to build their own EV industries as alternatives to China.

EVs are already nine per cent of cars sold in Thailand, boosted by a US$1.44 billion plant built by Chinese EV giant BYD in the province of Rayong, which will become operational in 2024.

Thailand, Southeast Asia’s largest car producer and exporter, has offered incentives including tax breaks and subsidies to attract EV makers and stimulate demand.

Indonesia, which holds the world’s largest nickel reserves that is vital for the production of EV batteries, has been determined to leverage these resources to build a domestic EV supply chain. It has aggressively courted foreign car and battery makers through relaxed investment rules.

India now has millions of EV owners, with popular motorbikes, scooters and rickshaws representing more than 90 per cent of the vehicles.

The market’s growth is due in part to a US$1.3 billion government scheme to encourage EV manufacturing in the country and provide discounts for customers.

3. Scope 3 disclosure in the spotlight

[Click to enlarge] The proportion of global emissions covered by companies with a target including Scope 3 emissions reductions has more than doubled since 2019, but only represents a third of all companies reporting a target. Source: CDP Corporate Environmental Action Tracker 2023

There will be more expectations from companies to focus on disclosing not just direct emissions from their value chain, but also their Scope 3 or indirect emissions from suppliers and end-users, said Ivan Li, director of strategy and implementation, Asia Pacific for energy consultancy ENGIE Impact.

Li cited a 2023 report of the CDP’s Corporate Environmental Action Tracker which revealed how the proportion of global emissions covered by companies with a target including Scope 3 has more than doubled since 2019,

“It’s a sign that companies are waking up to the importance of tackling indirect emissions and actively taking steps to reduce their overall environmental impact,” he said. “Businesses are also gaining a clearer understanding of how addressing Scope 3 emissions is crucial in their journey towards achieving net zero. We expect companies to face increased scrutiny and pressure to step up and provide more comprehensive reporting in 2024.”

A significant part of this increased attention can be attributed to new legislation enforcing stricter environmental reporting guidelines and sustainability practices, he added.

In June, the International Sustainability Standards Board (ISSB) published its disclosure standards, which cover general sustainability concerns (IFRS S1) and climate disclosures (IFRS S2).

The heightened scrutiny from government bodies and key stakeholders are prompting corporates to take proactive measures to enhance transparency. Many are opting for voluntary reporting structures, demonstrating their commitment through avenues like pursuing the approval of science-based targets by the Science Based Targets initiative (SBTi), which mandates reporting on relevant Scope 3 emissions.

4. Guidance away from greenwashing

Starbucks Korea has been recognised by the government for its low-impact recycling of its coffee grounds. Image: Mintel

Trust and reassurance will add a new layer to environmental, social, and corporate governance (ESG) initiatives as corporations adopt climate adaptability in their business practices, said Mintel’s Crabbe.

Mintel found that 74 per cent of those surveyed in Asia Pacific expect brands to take the lead on addressing environmental issues and spearhead climate solutions instead of relying on decades-long plans on carbon reduction made by governments and institutions.

“Consumers sense that many companies are not being clear about what they are doing to have a positive climate impact, and the positive effect their actions is having. People want to be more sustainable but lack information on how to do that. Brands can make this easier by being more transparent,” said Crabbe.

They can do this by explaining how they reduce food waste, energy and water use, packaging waste in their products, and how they are working towards adopting a circular economy business model, or how they are putting a certain amount of their profits back into sustainability efforts or supporting ethical organisations, he added.

5. Will election fever in Asia impact the sustainability agenda?

President Joko Widodo, also known as Jokowi, speaks to reporters in Indonesia. Image: Eduardo M. C.p, CC BY-SA 2.0

For the first time ever, there will be 40 national elections all over the world in the coming year, a quarter of which will be in Asia.

But observers have said that incoming administrations are likely to continue the policies of and hold similar stances on climate change as their predecessors.

Indonesia’s wildly popular leader Joko Widodo had prided himself on his move to ban nickel ore exports three years ago as a successful way to grow the local smelting industry and provide better welfare for the country. He expects his successor to continue the programme.

But Rere Christanto, manager of mining and energy campaign of Indonesian Forum for the Environment (WALHI), said that neither Widodo nor any of the presidential candidates speaks about the impacts of the downstream nickel industry in Indonesia, such as loss of forest areas, high crime rates and the violation of local environmental laws by corporations in the nickel sector.

“I think it is dangerous that none of the presidential candidates have spoken openly against environmental destruction and threats to communities from the nickel industry,” said Rere.

“Parties supporting the candidates also previously had a track record as proponents of mineral and coal laws which are the basis for accelerating damage caused by mining in Indonesia.”

The same is the case in India where frontrunner prime minister Narendra Modi has promised 500 gigawatts of clean energy before 2030, but has said little about reforms for coal. Elections are unlikely to change that, say observers.

Are there other emerging trends that we have missed? Let us know by writing to news@eco-business.com. This story is part of our Year in Review series.